Pasadena Real Estate Report

The 2024 real estate market has been an interesting one to say the least. We’ve seen mortgage interest rates climb to over 8%, while the post Covid housing inventory crisis is still struggling to recover. If that weren’t enough, we now have NAR losing a $1.8 billion dollar lawsuit, which threatens to disrupt an already fragile industry.

However, we are starting to see some light at the end of the tunnel, as we enter into the holiday season. This is the time of year when the real estate market tends to slow down. Many homeowners will be settling in for a long winter’s nap, in hopes of better conditions in the Spring. The good news, it’s looking like that will be the case.

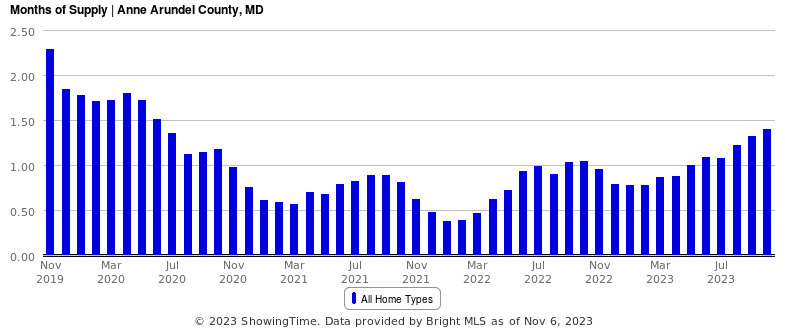

But first, let’s talk about opportunities for homebuyers as we close out the year. Currently, the months of supply in Anne Arundel County are the highest they’ve been since July of 2020. This means fewer homes are selling compared to the available inventory, giving buyers more options and less competition.

Last year, we saw very similar conditions. People who are buying and selling in the winter are typically very serious, and with fewer buyers in the market, the opportunity to negotiate increases. Although inventory levels are still very low, we’ve seen more price reductions this Fall. Buyers can expect fewer multiple offer situations, and to be able to lock in more favorable terms this Winter.

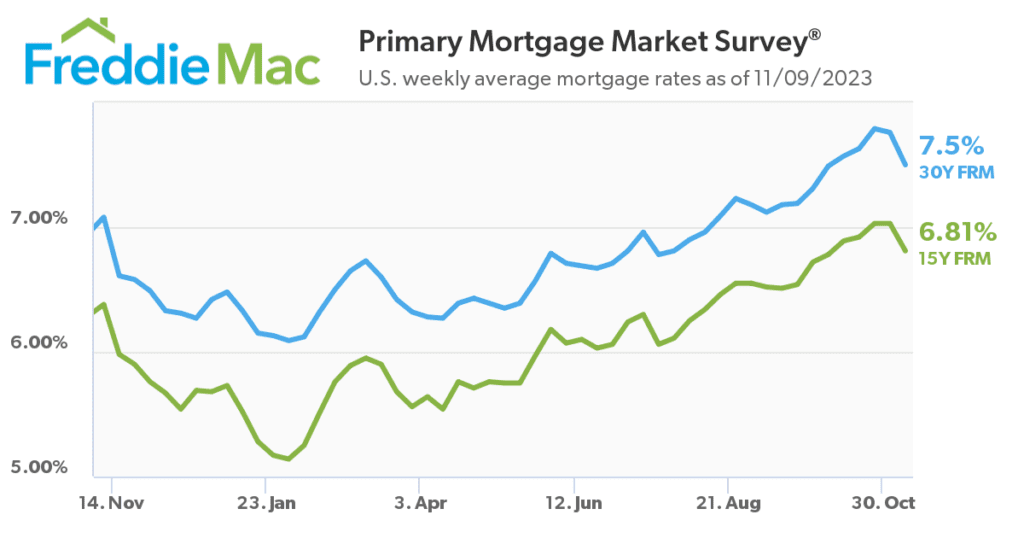

Perhaps the best news for buyers, is that the Fed has declared not to make any more increases to the Federal Fund Rate, which ultimately impacts mortgage rates. This news has resulted in interest rates falling about half a percent. It’s expected that the Fed won’t make any more hikes this year, which means we may have seen the top at 8% in late October. Some experts believe interest rates will fall to as low as 6% come this Spring.

A drop in mortgage interest rates means huge savings in terms of affordability for home buyers. However, this could also mean that those who have been waiting are going to enter the market, resulting in a perfect storm, increasing demand and pushing home prices up even higher.

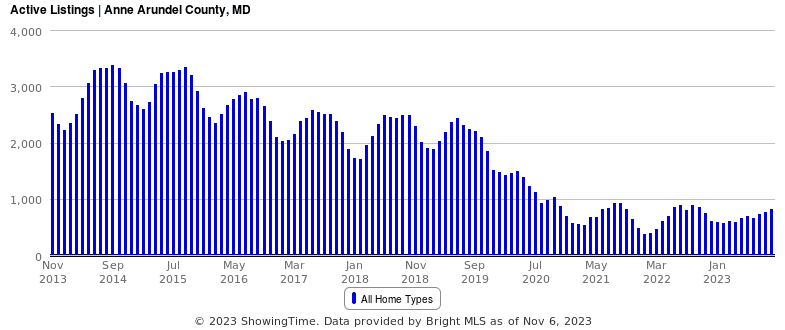

The low housing inventory has produced incredible results for many homeowners when they list their homes for sale. Multiple offers with great terms, often removing contingencies such as inspections and appraisals have been the norm. If the market conditions hold steady, and we remain in a low inventory “sellers market,” expect a lot of these results to remain the same.

When the pandemic struck in 2020, and interest rates plummeted, we experienced what some might call a housing crash. Like sledding down a hill, the ride was exhilarating! Now, we are faced with the difficult reality of trudging back up the hill, a far more arduous task. It won’t be easy to get back to a balanced market, where buyers have options, and homes take longer to sell, but one thing is certain; there will always be people needing to move.