Pasadena Real Estate Report

The year was 1990 when my family and I moved to Pasadena, Maryland. My parents had just purchased a brand new home in a community called Saybrooke by the Lake, being built by Koch Homes. It was a beautiful colonial with 4 bedrooms, 3 bathrooms, and a two car garage that was situated on a 1 acre lot. I still have fond vivid memories of the early days of moving into our new home, where I and my two sisters each had our own bedroom.

Mortgage Interest Rates

Part of the Baby Boomer generation, my parents weren’t the only ones buying up houses. The nineties were a time of relative peace and prosperity, when the median household income in Maryland was $38,857, and the median home value, just $115,500. Due to a recession in the 1980s, interest rates reached their highest point in modern history when they peaked at 18.63%, but by 1990, they had fallen to an average of 10.13%, and then to 6.49% in 1998.

Fast forward 30 years to 2020, when a global pandemic resulted in interest rates and housing inventory falling to historic lows. And here we are a few years later, where Federal rate hikes have led to interest rates topping off over 8% in the shortest time period in history.

Household Income and Home Values

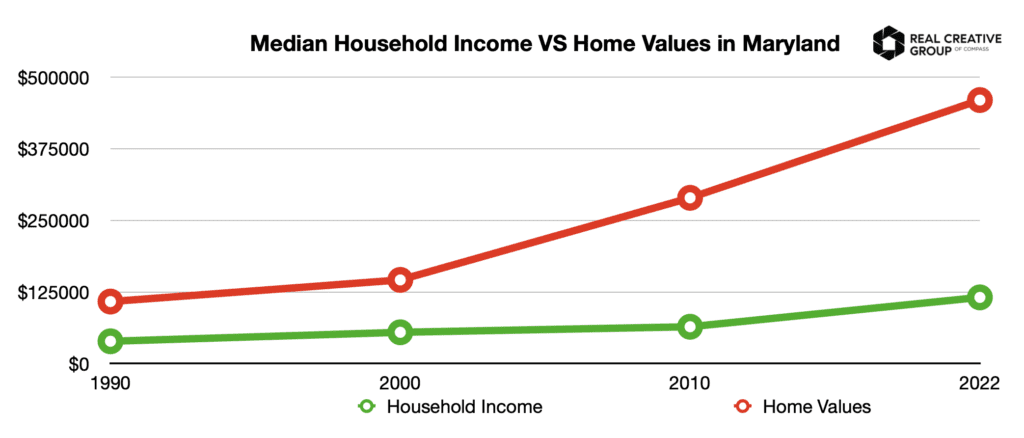

As of 2022, the median household income in Maryland has risen to $108,200, which is a 178% increase from 1990. However, the median home value in Maryland has increased to $460,000. That’s a 298% increase! Not a bad return on investment for all the Baby Boomers…but, what about their Millennial children buying homes in this market?

It’s easy to look back and say historically, interest rates were higher “back in the day,” but the reality is that this is not our parents’ real estate market. In order for all things to be equal, the median household income today would have to increase 120% up to $237,640, or the median home value would have to drop down to $321,990. This doesn’t factor in the current low supply and high demand of housing inventory or the additional emotional and financial impact it has on homebuyers today.

Affordability Affecting Home Buyers

Affordability is a major issue for Millennial home buyers today because of the widening gap between income, home prices, and the cost to borrow money. In 1990 the average homebuyer putting 20% down would have to come up with $23,100, which was 59% of their annual income. Their monthly payment would have been $811 (plus taxes and insurance) and equal to 25% of their monthly income. Today, the average homebuyer putting 20% down would have to come up with $92,000, which is 85% of their annual income. And their monthly payment of $3,229 (plus taxes and insurance) and equal to 36% of their monthly income.

Of course, we can’t blame the Boomers for wanting to live the American Dream. They were simply subject to their own market conditions, and if anything, it goes to show that real estate can be a great long-term investment vehicle. In 2021, I helped my parents sell my childhood home, and albeit a bit sad, it was a wonderful experience to watch them be rewarded for their hard work and commitment as they moved on to the next chapter of their lives.

It is, however, unfair to compare those market conditions to what we see Millennial buyers facing today, even if interest rates are still historically lower. There are a lot of uncertainties in the world today, and no one has a crystal ball. It is going to require a new generation of leaders to solve these complex problems. There is one thing I am certain of, people will always need a place to call home and raise a family, no matter what the cost.